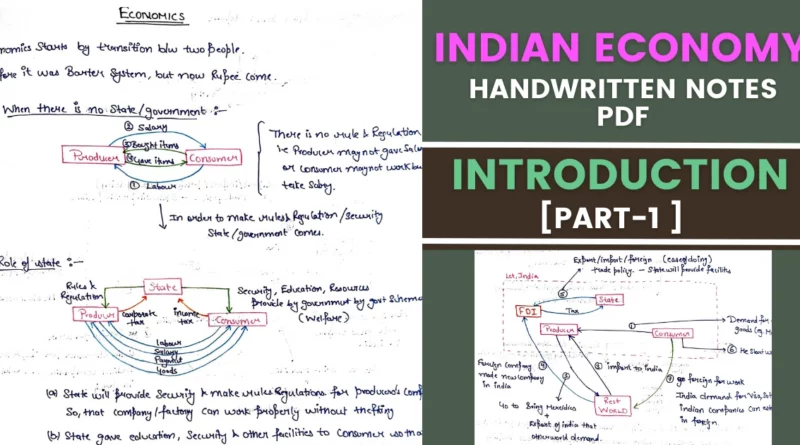

Indian Economy Handwritten Notes for UPSC Pdf in English [Part-1]

If you are looking for Indian Economy Handwritten Notes for UPSC PDF, then you are at the right place. This is Part-1 of Economy Handwritten Notes. Other Parts will be uploaded soon according to the user response to this pdf. If you are interested in obtaining more handwritten notes on topics such as the economy and other subjects, please feel free to share your thoughts and comment below.

PDF Below!

The PDF begins with an introduction to the economy, explaining the various components of an economy such as goods and services, factors of production, and the role of markets. It then explains the concept of the money market, which is the market where short-term financial instruments such as treasury bills, commercial paper, and certificates of deposit are traded. The PDF covers the functions of banks and financial institutions in the money market, including their role in providing credit, creating money, and managing risks.

| Notes | Indian Economy |

| Type | |

| Content | Introduction |

| Mode | Read Only |

| Part | First |

Indian Economy Handwritten Notes for UPSC Pdf in English [Part-1]

I. Introduction

- Components of an economy (goods and services, factors of production, markets)

- Role of Money in the Economy

- Importance of understanding finance

II. Money Market

- Definition of money market

- Short-term financial instruments (treasury bills, commercial paper, certificates of deposit)

- Functions of banks and financial institutions in the money market (credit provision, money creation, risk management)

III. Evolution of Money

- Barter system and its limitations

- Development of modern-day currency

- Efficiency of using money in economic transactions

IV. Types of Money

- Commodity money

- Fiat money

- Representative money

- Advantages and disadvantages of each type

V. Money Supply

- Control of money supply by central banks

- Effects of Changes in money supply on the Economy

VI. Financial Instruments

- Fixed deposits (FDs)

- Recurring deposits (RDs)

- Benefits and drawbacks of FDs and RDs

- Liquidity coverage ratio (LCR)

- Weighted average lending rate (WALR)

VII. Deposits and Credits

- Primary deposits (savings deposits, current deposits)

- Secondary deposits (created when banks lend money)

- Role of Credit in the banking system

- Creation of credit entries

VIII. Banking Concepts

- Cash reserve ratio (CRR)

- Vault cash

- Assets and liabilities

- Management of assets and liabilities for financial stability

Next, the document explains the concept of a barter system, which is an economic system where goods and services are exchanged directly for other goods and services without the use of money. The document explains how the barter system has evolved over time into modern-day currency and how the use of money has made economic transactions more efficient.

The PDF then goes on to explain the different types of money such as commodity money, fiat money, and representative money. It provides examples of each type of money and discusses the advantages and disadvantages of each type. The document also covers how the money supply is controlled by central banks, and how changes in the money supply can affect the economy.

The next section of the PDF covers various financial instruments such as fixed deposits (FDs) and recurring deposits (RDs), and explains their benefits and drawbacks. It also discusses the concept of liquidity coverage ratio (LCR), which is the ratio of a bank’s high-quality liquid assets to its total net cash outflows over a 30-day stress period. The document also covers the concept of weighted average lending rate (WALR), which is the average interest rate at which a bank lends money.

The PDF then moves on to cover the concept of primary deposits, which are deposits made directly with the bank, such as savings deposits and current deposits. It also explains the concept of secondary deposits, which are created when banks lend money. The document covers the role of credit in the banking system and explains how credit entries are created.

The final section of the PDF covers various banking terms such as cash reserve ratio (CRR), which is the percentage of a bank’s deposits that it must keep in reserve with the central bank. It also covers the concept of vault cash, which is the cash that a bank holds in its vaults. The document also covers the concept of assets and liabilities in the banking system and explains how banks manage their assets and liabilities to ensure their financial stability.

Overall, this PDF provides a comprehensive overview of various economic and financial concepts that are important to understand for anyone interested in money and finance. It covers the basics of the economy, the role of money in the economy, financial instruments, and banking concepts, making it a valuable resource for anyone looking to improve their understanding of finance.

Indian Economy Handwritten Notes for UPSC Pdf [Part-1]

Loading…

Economy-PDF-Part-1If you are interested in obtaining more handwritten notes on topics such as the economy and other subjects, please feel free to mail at “info@newscoop.co.in“

Thank You!