Commercialization of Agriculture: British India

The commercialization of agriculture in British India marked a significant turning point in the country’s agrarian economy. The ...

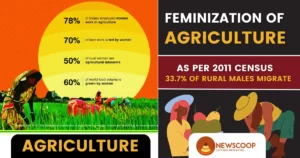

Feminization of Agriculture in India: Causes & Impacts

Agriculture has long been considered the backbone of the Indian economy, providing employment and sustenance to a significant ...

Payment Banks in India: Features & Regulations

Payment banks play a significant role in India’s banking sector, aiming to extend financial services to the unbanked ...

What is Retail Inflation? Factors & Measures in India

What is Retail Inflation? Retail inflation, also known as consumer price index (CPI) inflation, refers to the rate ...

Small Finance Banks – Features & Regulations in India

When it comes to competitive exams like the UPSC (Union Public Service Commission), having a clear understanding of ...

Tobin Tax in India: Objectives & Background

The Tobin Tax, also known as the currency transaction tax or the Tobin Levy, is a proposed tax ...

Bad Banks: NARCL & IDRCL | Working in India

Recently, bad banks have gained considerable attention in the banking and financial sector. These specialized entities focus on ...

Regional Rural Banks (RRBs) in India – Objectives & Functions

Regional Rural Banks (RRBs) have played a significant role in India’s financial inclusion journey, particularly in rural areas. ...

List of Best NeoBanks in India: Characteristics & Regulations

In recent years, the financial technology (FinTech) sector in India has witnessed a remarkable transformation, with the emergence ...

You are wrong shivaji maharaj has eight wives 1. Sai bai 2. Soyrabai 3. Putalabai 4.Sakwarbai 5. kashibai 6. Laxmibai…