In February 2023, the Central government of India implemented an increase in the windfall profit tax on domestically produced crude oil and the export of diesel and aviation turbine fuel (ATF). This decision aims to generate more revenue for the government and promote a fairer distribution of profits.

In this article, you will get to know about the windfall tax, the challenges associated with its implementation, the purpose behind its consideration, and the reasons it has been discussed in the context of UPSC preparation.

What is Windfall Tax?

A windfall tax is a form of tax imposed on unexpected or excessive profits or gains obtained by individuals, businesses, or industries due to external factors beyond their control. It is typically levied when there is a sudden surge in profits resulting from favorable market conditions, natural resource discoveries, or regulatory changes.

Aim: The aim of a windfall tax is to capture a portion of these windfall gains and redistribute them for the benefit of society or address income inequalities. It is often seen as a mechanism to promote fairness and social justice.

Let’s Understand with an Example

In India, during the COVID-19 pandemic, some companies in the pharmaceutical industry have made a lot of extra money because of the high demand for medicines and healthcare products. To make things fair, the government may decide to impose a windfall tax on these companies.

For example, if a pharmaceutical company normally makes a profit of 10% but during the pandemic, their profit increases to 30%, the extra profit, or windfall gain, is 20%. The government might then charge a tax of 15% on this extra profit.

Let’s say the company made ₹100 crore in total revenue during the pandemic, with a normal profit of ₹10 crore. The extra profit would be ₹20 crore. Applying the 15% windfall tax on this extra profit means the company would have to pay ₹3 crores to the government as tax.

The money collected from the windfall tax can be used to support the healthcare system, help people who are most affected by the pandemic, or invest in future healthcare needs.

Examples of Major Windfall Taxes

Here is a list of examples of major windfall taxes that have been implemented or considered in India:

- Oil Sector Windfall Tax

- Telecom Spectrum Windfall Tax

- Coal Windfall Tax (proposed)

- COVID-19 Pandemic Windfall Tax (proposed)

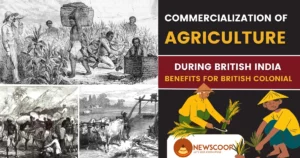

India Introduced Windfall Tax in 2022

India introduced a windfall tax in July 2022 in response to exceptional gains made by domestic crude oil producers due to the global impact of the Russia-Ukraine war. The tax was imposed on the oil industry to address the increase in government spending caused by reduced central excise charges and additional expenditures on food and fertilizer. As a result, an additional ₹6/litre was added to petrol and aviation turbine fuel (ATF), and ₹13/liter was imposed on diesel.

Reasons for Implementing

There are several reasons for implementing a windfall tax. Here are some of the common reasons:

- Addressing Excessive Profits: When certain industries or businesses earn unexpectedly high profits, it is important to ensure a fair distribution of wealth and prevent excessive gains.

- Promoting Fairness and Equity: Implementing a tax on excessive profits helps promote fairness by ensuring that companies contribute their fair share to society, particularly during periods of extraordinary gains.

- Generating Additional Revenue: Such a tax can generate additional revenue for the government, which can be used to fund public programs, invest in infrastructure, or support social welfare initiatives.

- Correcting Market Imbalances: Imposing a tax on excessive profits helps correct market imbalances and prevent the concentration of wealth and power in a few hands.

- Targeted Funding: The revenue generated from the tax can be specifically allocated to fund programs or initiatives aimed at addressing societal needs or supporting vulnerable populations.

Advantages & Disadvantages of Windfall Tax

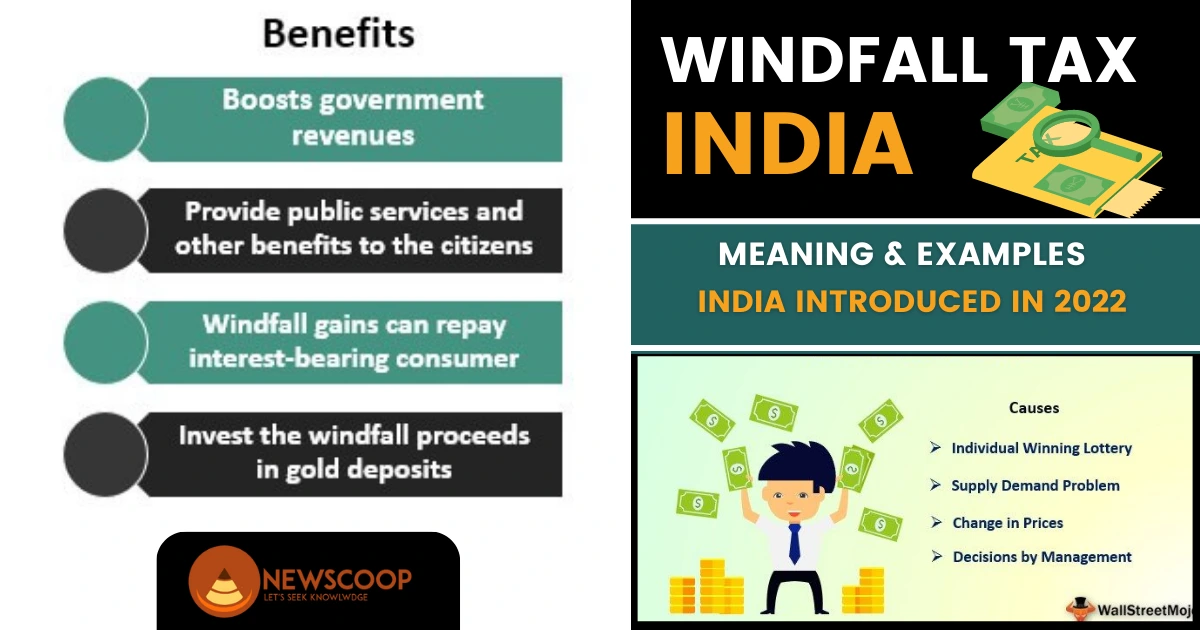

Advantages of Implementing a Tax on Excessive Profits:

- Promotes fairness and equity.

- Generates additional government revenue.

- Corrects market imbalances.

- Incentivizes responsible business practices.

Disadvantages of Implementing a Tax on Excessive Profits:

- Potential negative impact on investment.

- Complexity and administrative burden.

- Risk of tax avoidance.

- Potential impact on competitiveness.

IMF Guidelines

The International Monetary Fund (IMF) provides some guidelines regarding windfall taxes. Here are the key points:

- Permanent Tax on Windfall Profits: The IMF suggests introducing a permanent tax on windfall profits generated from fossil fuel extraction. This aims to capture excess profits and ensure a fair distribution of resource revenues.

- Caution with Temporary Taxes: The IMF advises caution when implementing temporary taxes on windfall profits. Such taxes may increase investor risk, be more distortionary if poorly designed or timed, and may not provide significant revenue benefits compared to a permanent tax on economic rents.

- Taxing Economic Rents: The IMF recommends imposing the windfall tax on a portion of economic rents, which refers to excess profits beyond normal returns. This ensures that the tax targets excessive gains rather than legitimate returns on investment.

Conclusion

In conclusion, a windfall tax is a policy measure implemented by governments to capture excess profits earned by certain industries or businesses during exceptional circumstances. It aims to promote fairness, generate additional revenue, correct market imbalances, and incentivize responsible practices.

However, careful consideration of its design, potential impact on investment and competitiveness, and effective administration are essential for maximizing its benefits. Overall, a well-designed windfall tax can contribute to a more equitable and sustainable economic system.

Thank You!